Support Us

Pennsylvania Personal Income Tax Credit (SPE)PA Personal Income Tax Credit (SPE)

Do you want to support the students of The Circle School by making a donation? If you live in Pennsylvania, it’s easier than you think!

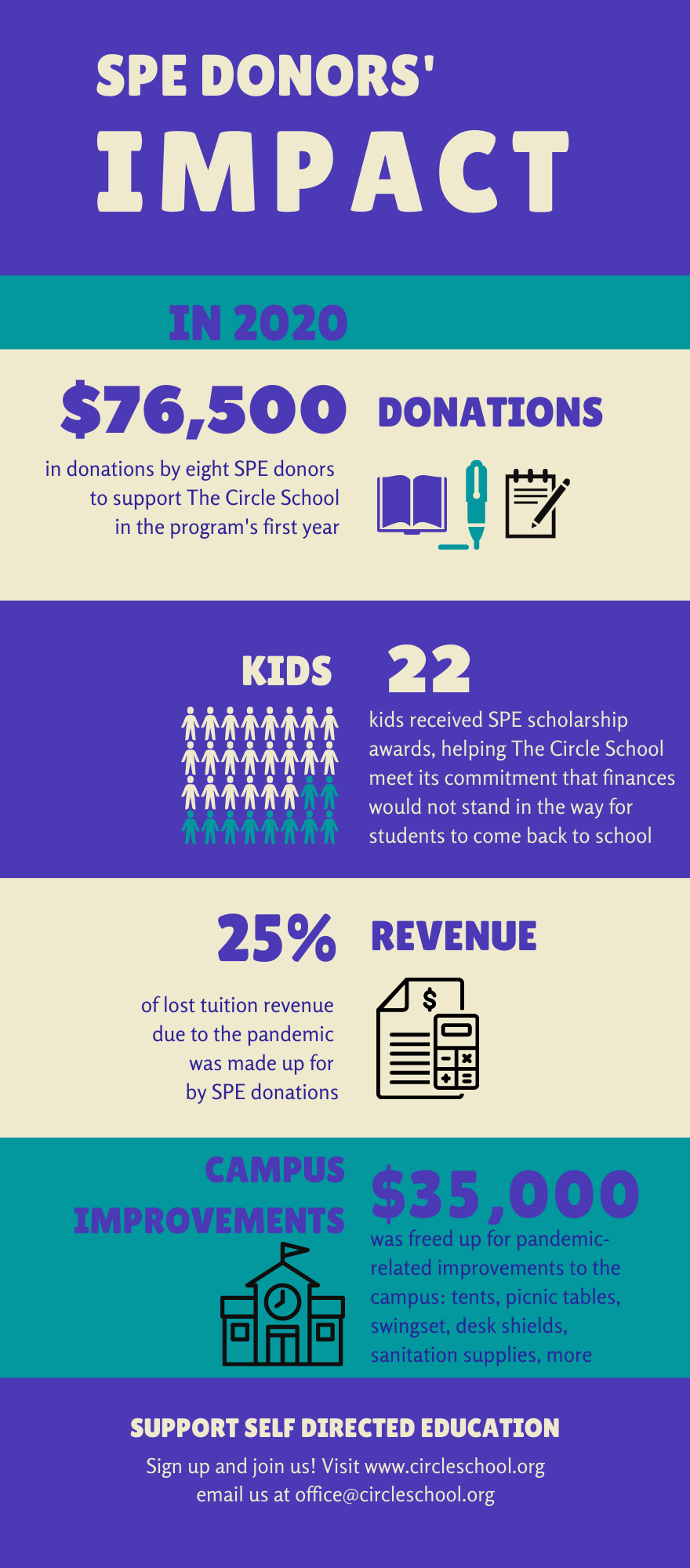

You can help grow The Circle School’s financial aid program by taking advantage of Pennsylvania’s 9-1 Scholarship Matching Program.

Private individuals can donate through the program and get 90% of their contributions back as a state tax credit! Check out this 90 second video about how it works:

In effect, you can redirect your tax dollars to benefit children and education, with little cost to you. We partner with the Central Pennsylvania Scholarship Fund to secure tax credits for donors year round.

Ready to participate? Complete this simple form and send it to Tami Clark at CentralPAScholarshipFund@gmail.com (and please cc office@circleschool.org). Want more information? Read on or fill in the request for information below.

The Circle School is a state-approved Scholarship Organization, ready to receive your donations to EITC, OSTC, and PKTC. 100% of your donation will be awarded to income-qualified children.

The Circle School admits students on a first-come, first-served, open admissions basis. Admissions are blind to financial need, and families pay only what our financial aid process determines they can afford. Each year the school grants more than $400,000 in financial aid. The school depends heavily on the generosity of business and individual donors.

Businesses can take advantage of these tax credits too! Learn more here.

For more information, complete the form below, or contact the school at:

717-564-6700

office@circleschool.org or financial@circleschool.org

Thank you for making The Circle School accessible to more kids!